REPO/Lend is the ultimate platform for fully Collateralized Lending & Borrowing. Our innovative solution allows for effortless Borrowing/Lending transactions with Crypto/Fiat or Crypto/Crypto pairs.

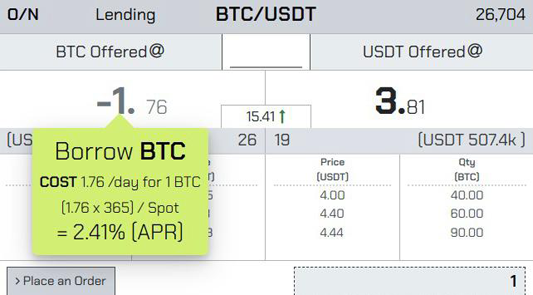

An exchange user who possesses unused inventory of Crypto or Fiat may want to capture yield by lending it to the market. By offering one’s unused balances on XCDE, an anonymous market counterparty can borrow and pay an interest in the form of a “BUY/SELL” price difference

FXCH clearing mitigates risks by supervising collateral from all parties and simplify the settlements.

One BUYs and SELLs an Instrument at the same time on 2 different value dates. The Near_Leg being immediately settled (Intra-day repo) or today at EoD, the second either Tomorrow 5pm NY, one or 2 weeks ahead. This trade unwinds itself with a pre-agreed price difference (REPO traded price) which equates to an interest payment.

Instruments on REPO/Lend are described with 3 parts:

Underlying Instrument: (BTC/USD Spot, ETH/USDT Spot eyc.)

Tenor: (ON, 2w, ID etc.)

Type: (REPO)

| Timestamp ⌃ | Instrument | Swap Leg | Value Date | Direction | Qty | Price | Swap Price | Swap Rate | TradeID |

|---|---|---|---|---|---|---|---|---|---|

| 20 Jun - 11:18:22 | BTC/USDT | FL | 27 Jun 2023 | BOUGHT | 100.00 | 29,982.7397 | 17.2603 | 3% | TR_15_1581323923540_FL |

| 20 Jun - 11:18:22 | BTC/USDT | NL | 20 Jun 2023 | SOLD | 100.00 | 30,000 | TR_15_1581323923540_NL |

Buy 100 BTC today, Sell 100 BTC in a week

XCDE has operated REPO/Lend for over 2 years in a Web-only form, but recently decided to release access to the market via API.Our choice is a set of REST and Websocket end-points replicating the battle-tested FIX protocol messages and workflows.

Please register and get in touch if you are interested to explore and test these End-points with your trading app.